You Can Get My Expert Advisor For FREE Now

Learn More (Click Here)

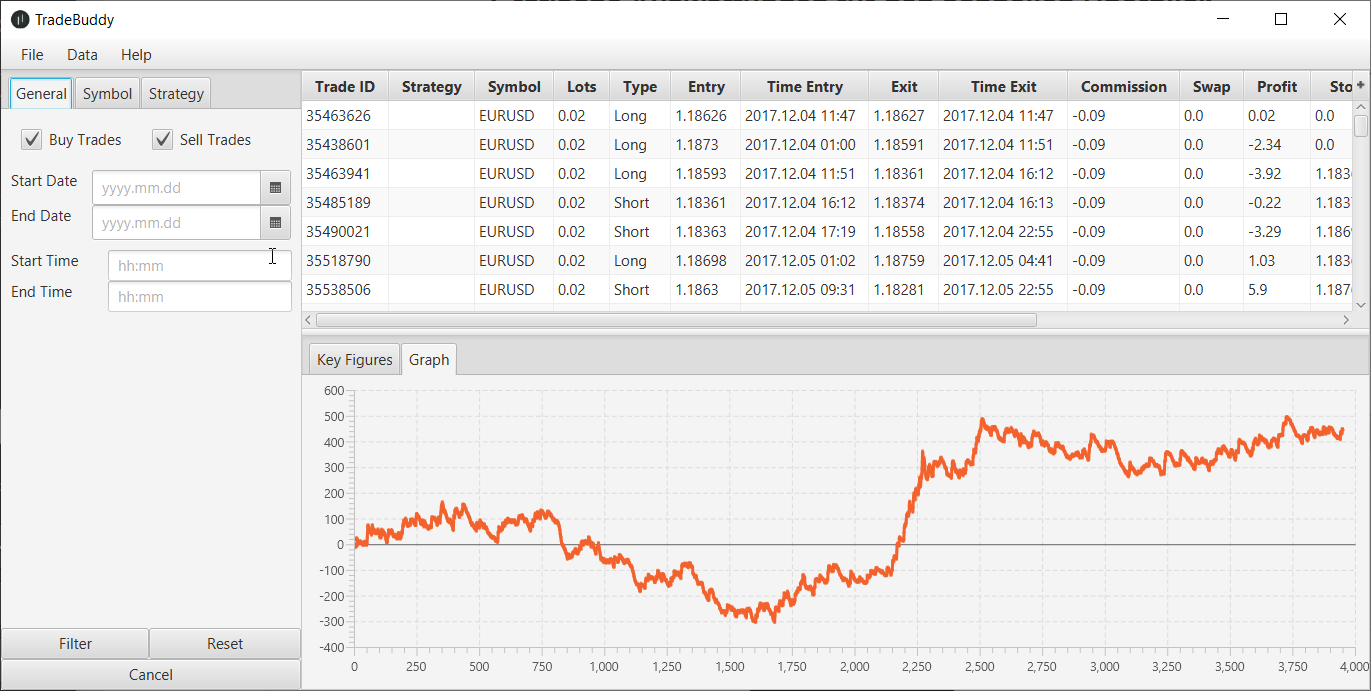

Get The TradeBuddy, The Free Trading Journal!

The TradeBuddy combines intuitive operation with optimal and practice-oriented functionality.

It supports you consistently in the trading business and shows you exactly how you can achieve better results.

René Balke

René is the managing director and founder of BM Trading GmbH. Since completing his dual studies at a major German bank, he has been intensively involved in trading on the capital market. Before starting his own business, he worked in an asset management company. Privately, he invests in stocks and trades Forex mostly automatically. He argues that if you can explain it, you can automate it. The programming of tools for fully or partially automated trading strategies is his specialty.

What is Automated Trading?

Switch systems on and let them run - we specialize in systematic trading and strategy development. As the name suggests, trading here is automated and there is no room for interpretation. The trading decisions are made and executed by computer programs.

A simple example of such a program would be the following: As soon as the 50-day line of a moving average indicator crosses the 200-day line from bottom to top, a long position is opened. If the 50-day line then falls below the 200-day line again, this long position is closed and a short position is opened. As soon as the fast average is again above the slower average, the short position is closed out and a long position is opened again. This pattern then continues on and on. The dealer does not have to be active, as all calculations and actions are taken over by the program.

In general, all trading systems that are based on clear rules and are not subject to subjective influences can be programmed. The programming usually refers to chart-technical patterns, but news and other external factors can also be included and evaluated. Large funds are currently working on fully automated trading programs, some of which even have artificial intelligence and are able to learn and develop independently.

In addition to fully automated trading, there is also the option of trading semi-automatically. This means that the human trader decides, for example, when exactly to use a certain trading program and when not. A partially automated trading approach would also exist if all trades were opened by a person, but then managed by a program. In that case, for example, the management of goal and stop setting could be given up.